Business

India’s New Silver Collateral Rules for Loan Accessibility

Starting April 1, 2026, silver jewelry and ornaments can be used as collateral for loans in India.

India to Allow Silver Jewelry as Loan Collateral Starting April 2026

Estimated Reading Time: 4 minutes

Key Takeaways

- Starting April 1, 2026, silver jewelry and ornaments can be used as collateral for loans in India.

- The collateral limit is set at Rs. 2.5 lakh (approximately $3,000 USD), equivalent to 10 kg of silver.

- The policy aims to remonetize silver and provide access to formal credit, particularly benefiting rural households.

- A circular detailing the new regulations will be issued by the Reserve Bank of India (RBI) in April 2026.

- India will revise trade policies to manage gold and silver imports effectively.

Context / Background

India will implement new regulations from the Reserve Bank of India (RBI) on April 1, 2026, permitting silver jewelry, ornaments, and coins to be pledged as collateral for loans. This historic policy will allow borrowers to use up to Rs. 2.5 lakh (approximately $3,000 USD), which corresponds to a collateral limit of 10 kg of silver or 1 kg of gold, effectively remonetizing silver in a significant way.

Historically, gold has been a primary asset used as collateral in India, where many households hold vast amounts of this precious metal. The new policy aims to level the playing field by including silver, which has often been overlooked despite being a major household asset. Currently, India is estimated to possess around 34,600 tonnes of gold valued at approximately $3.8 trillion, while substantial silver holdings exist but remain largely undocumented.

Key Details on Silver Collateral Policy

The new regulations will only apply to physical silver in the form of jewelry or ornaments, and it will not include silver bullion, ETFs, or excess-weight coins. The collateral ratio is set at 10:1 for silver to gold, which differs from the global spot ratio that is often above 70:1. This regulatory change is expected to standardize the valuation process based on purity, implementing transparent pricing mechanisms that utilize the lower of the 30-day average or the previous day’s closing price from IBJA/SEBI-regulated exchanges.

The Reserve Bank is expected to provide a full circular outlining the framework under “RBI (Lending Against Gold and Silver Collateral) Directions, 2025” in April 2026. This policy not only facilitates access to formal credit but also works to unlock significant household wealth that has been labeled as “dead capital.”

Impact on Households and Market Dynamics

This policy will predominantly benefit rural and semi-urban households, enabling them to transform their silver assets into formal credit and reducing their dependence on informal moneylenders. It is estimated that this could unlock billions of dollars worth of household wealth tied up in silver. Additionally, the inclusion of silver in loan collateral is anticipated to boost domestic demand for silver jewelry and fabrication, while tightening global supply.

Financial analysts predict a psychology shift surrounding silver valuation, likely leading to increased market activity. As the collateral facilitation gains traction, improvements in liquidity and pricing transparency are expected in the silver market.

Trade and Import Policies on Gold/Silver

In a related development, India is adjusting its trade policies to exclude gold and silver from future free trade agreements (FTAs) to control potential import surges and prevent duty evasion. This includes recent FTAs that have witnessed significantly increased gold imports due to loopholes. Additionally, silver bullion duties are set to decrease from 15% to 6% in 2025, while import restrictions on plain silver jewelry and unmounted silver will continue until March/April 2026, requiring specific licenses to protect local jewelers.

Passenger Import Rules

Currently, passengers are allowed to bring in up to 10 kg of silver with a duty of 6%, while a higher duty rate of 36% is applicable for others, highlighting the need for regulatory control over precious metals.

What’s Next

These measures represent India’s strategic goal of integrating traditional savings, such as gold and silver, into the formal financial system while safeguarding domestic markets amidst global supply constraints. Analysts recommend maintaining gold and silver allocations in 2026 investment portfolios, supporting their ongoing value. The anticipated RBI framework will mark a significant development in both consumer finance and the metal markets, potentially reshaping how households interact with their silver assets.

FAQ Section

What is the new silver collateral policy in India?

The new silver collateral policy allows silver jewelry, ornaments, and coins to be used as collateral for loans, effective from April 1, 2026, with a limit of Rs. 2.5 lakh (approximately $3,000 USD).

How will this policy impact households?

The policy is expected to benefit rural and semi-urban households by allowing them to convert their silver assets into formal credit, reducing reliance on informal moneylenders and unlocking significant wealth.

What are the trade policy changes regarding silver and gold?

India is excluding gold and silver from future free trade agreements to manage imports and is reducing silver bullion duties from 15% to 6% in 2025 while maintaining import restrictions until early 2026.

When will the RBI release the full circular on the new policy?

The Reserve Bank of India is expected to release the full circular detailing the new silver collateral regulations in April 2026.

Business

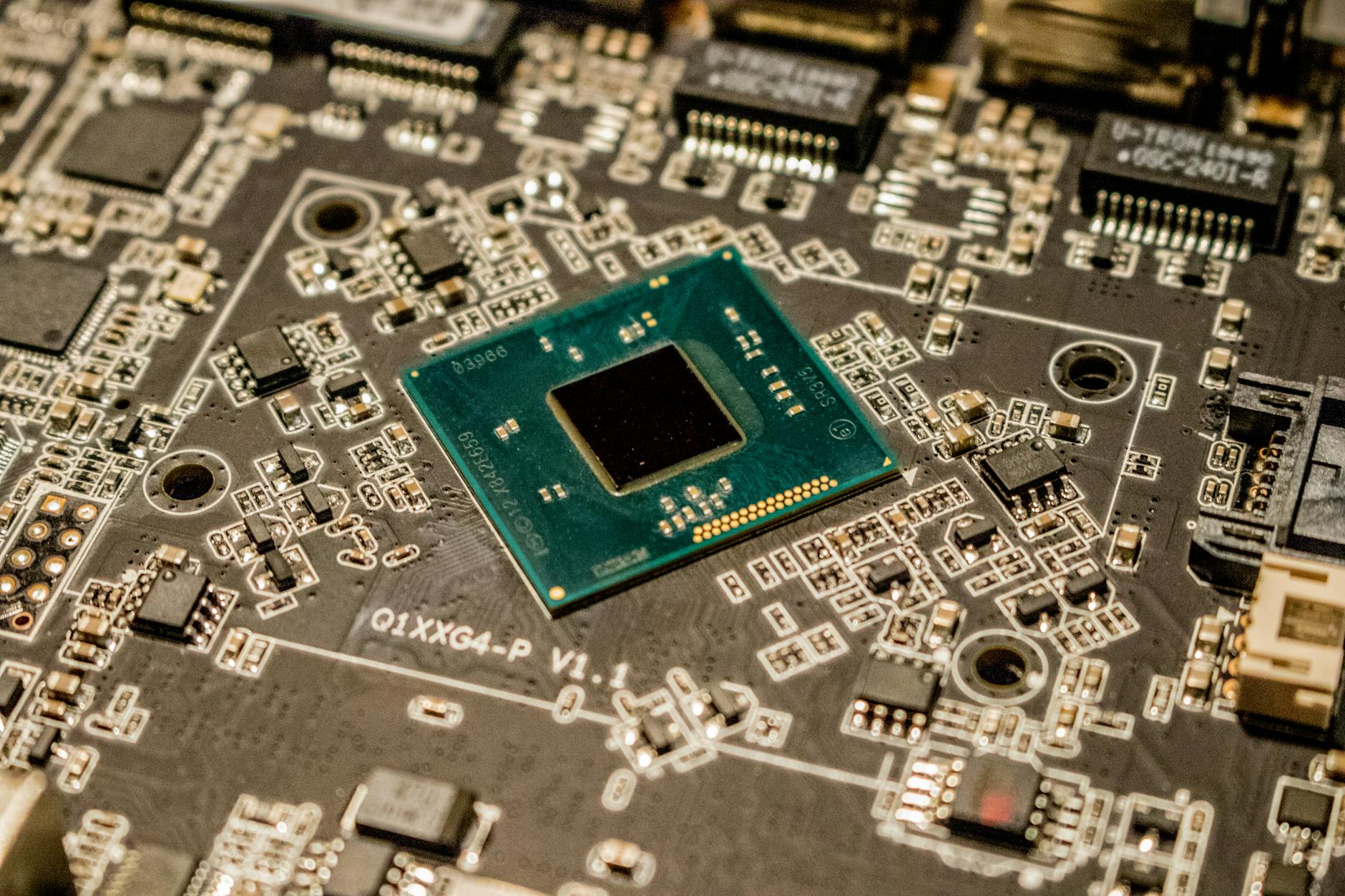

Broadcom and TSMC Shape AI Semiconductor Industry

Broadcom and TSMC Position Themselves as Key Players in the AI Semiconductor Landscape

Estimated Reading Time: 5 minutes

Key Takeaways

- Broadcom and TSMC are enhancing their roles in the AI semiconductor market through potential acquisitions and partnerships.

- Broadcom is considering an acquisition of Intel’s chip design operations but faces strategic complexities.

- TSMC may manage Intel’s manufacturing operations, encouraged by U.S. government policies.

- Both companies are poised to reshape competitive dynamics in the semiconductor industry amidst Intel’s challenges.

- Broadcom reported significant revenue growth, underscoring the rising demand for custom AI chips.

Main Content

Context / Background

Broadcom and TSMC are emerging as key players in the semiconductor market, especially with the growing demand for AI infrastructure. Broadcom specializes in networking gear and custom silicon architectures, while TSMC, the largest semiconductor foundry, controls approximately 70% of the market for advanced chip manufacturing. The collaboration aims to meet the increasing need for AI accelerators.

Key Details

Broadcom is reportedly interested in acquiring Intel’s chip design and marketing operations following informal discussions. However, any formal offer is contingent upon securing a partner to assume control of Intel’s manufacturing division, illustrating the strategic complexities involved. Meanwhile, TSMC is in preliminary discussions to potentially acquire or manage Intel’s manufacturing division, spurred by supportive government policies from the Trump administration. This could represent a substantial shift from Intel’s historically integrated model of design and manufacturing to a more outsourced strategy.

Furthermore, TSMC has introduced the idea of a joint venture with partners like Nvidia, AMD, and Broadcom to manage Intel’s foundry while ensuring no more than a 50% ownership stake to avoid complete foreign control over a vital asset in U.S. tech infrastructure.

Broadcom’s recent financial results illustrate its robust position within the AI semiconductor sector, reporting revenues of $18.02 billion for Q1 FY2026, up 28% year-over-year. The rising demand for custom AI chips is a major factor driving this growth, with forecasts estimating revenues could double year-over-year. TSMC also witnessed a Q4 2025 revenue of $33.73 billion, a 20.5% increase year-over-year, and expects a strong Q1 2026, reinforcing confidence in sustained spending on AI infrastructure.

Impact

The ramifications of these developments are substantial for a variety of stakeholders. Broadcom’s emphasis on custom AI architectures provides data centers with specialized solutions, potentially boosting the performance of essential technology companies such as Microsoft, Alphabet, Amazon, and Meta, all of which utilize TSMC’s advanced chip manufacturing capabilities. The capacity of Broadcom and TSMC to deliver high-performance computing chips will likely enhance their significance amid the rising demands for AI.

Additionally, the situation surrounding Intel mirrors broader industry challenges. Intel’s stock has plummeted by 60%, alongside considerable workforce cuts and setbacks in its manufacturing strategy under former CEO Pat Gelsinger. These difficulties create opportunities for Broadcom and TSMC to assume a more pivotal role within the semiconductor ecosystem.

The partnership between Broadcom and TSMC not only strengthens their market positions but also alters the competitive dynamics of the semiconductor industry. With TSMC manufacturing chips at advanced nodes like 3nm and 5nm—essential for high-performance computing—the collaboration could streamline the pathway toward more efficient and powerful AI solutions.

What’s Next

As Broadcom and TSMC continue to negotiate their positions, the industry will be closely monitoring how these discussions influence the future of Intel. The success of potential acquisitions or partnerships could indicate a significant restructuring within semiconductor manufacturing and design dynamics. For the tech market, this realignment may foster more competitive pricing and advanced technologies tailored for AI applications. Ongoing developments will be essential to observe as Broadcom and TSMC navigate this landscape, potentially benefiting a diverse range of stakeholders, including consumers relying on cutting-edge technology.

FAQ Section

What are the plans for Broadcom and TSMC in the AI semiconductor market?

Broadcom and TSMC are considering potential collaborations and acquisitions, including interest in Intel’s chip design and manufacturing operations, to enhance their market positions in the AI semiconductor landscape.

How is Intel’s situation impacting the semiconductor industry?

Intel’s challenges, including stock declines and operational setbacks, are creating opportunities for Broadcom and TSMC to become more central players in the semiconductor ecosystem, as they seek to seize market share amidst Intel’s struggles.

Business

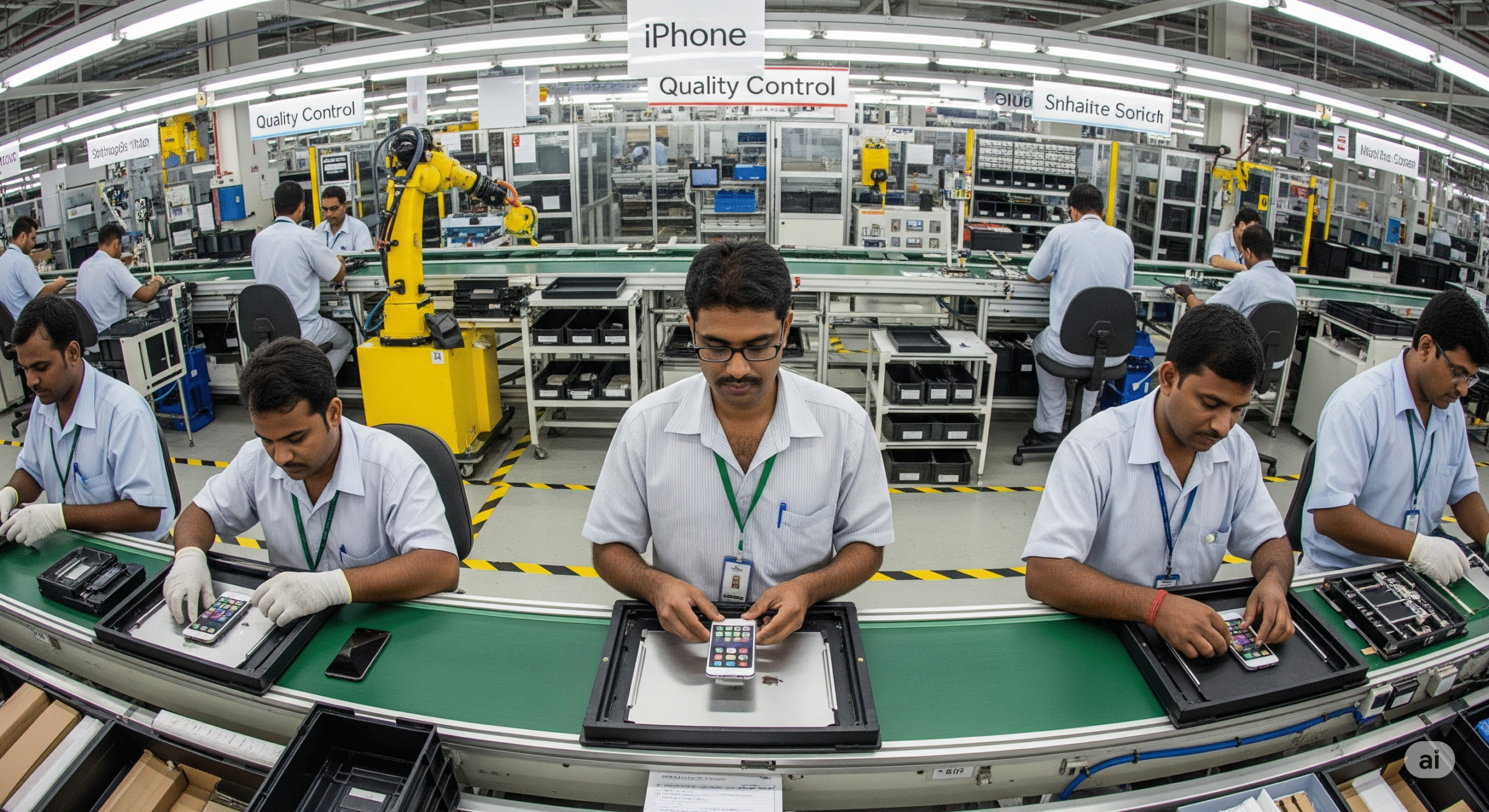

Apple’s India Strategy Faces New Hurdles Amid Trump’s 25% iPhone Tariff Threat

Trump’s 25% iPhone Tariff Could Backfire — GTRI Says India Still Wins

Apple’s ambitious shift of iPhone manufacturing to India is encountering fresh challenges as former President Donald Trump threatens a 25% tariff on all foreign-made smartphones, including iPhones assembled in India. Despite this, a recent report by the Global Trade Research Initiative (GTRI) suggests that producing iPhones in India remains more cost-effective than relocating production to the U.S

Apple’s Manufacturing Pivot to India

In response to escalating U.S.-China trade tensions, Apple has been diversifying its supply chain by increasing iPhone production in India. Foxconn, Apple’s primary assembly partner, has invested $1.5 billion to expand its manufacturing infrastructure in southern India. This move is part of Apple’s broader strategy to reduce reliance on Chinese manufacturingAccording to a GTRI report, assembling an iPhone in India costs approximately $30 per unit, significantly lower than the estimated $390 per unit if produced in the U.S. Even with a 25% tariff, the cost would rise to only $37.50, still far below U.S. production costs. This cost advantage is attributed to lower labor expenses and government incentives under India’s Production-Linked Incentive (PLI) scheme.

Trump’s Tariff Threat and Its Implications

On May 23, 2025, Trump announced plans to impose a 25% tariff on all smartphones not manufactured in the U.S., explicitly targeting Apple and Samsung. He emphasized that iPhones sold in the U.S. should be produced domestically, or else face the tariff. This announcement led to a significant drop in Apple’s stock value, wiping out approximately $70 billion.

Analysts warn that such tariffs could lead to higher consumer prices, supply chain disruptions, and potential inflation. The GTRI report indicates that the value of a $1,000 iPhone is distributed across various countries, with Apple retaining the largest share of $450 for brand, design, and software. The assembly process, primarily conducted in India and China, accounts for only about $30 per device.

Long-Term Outlook

Despite the tariff threats, Apple’s commitment to Indian manufacturing appears steadfast. The company plans to source more than 60 million iPhones annually from Indian factories by 2026. This strategy not only mitigates geopolitical risks but also leverages India’s cost advantages and growing skilled labor force.

However, the imposition of tariffs could strain U.S.-India trade relations and impact global supply chains. While Trump’s policies aim to bolster domestic manufacturing, the feasibility of shifting complex production processes to the U.S. remains questionable due to higher costs and infrastructure challenges.

Business

Ford to Restart Chennai Plant for Engine Exports, Not Vehicle Production

Ford will revive its Chennai plant to export engines, ending vehicle production in India and focusing on an export-only manufacturing strategy.

Ford Motor Company is set to revive its inactive manufacturing facility near Chennai to produce and export engines and related components, marking a significant shift in its India strategy. The plant, located in Maraimalai Nagar, has been idle since mid-2022.

Sources familiar with the development revealed that vehicle manufacturing will not be part of Ford’s renewed operations in India. Instead, the company is repurposing the facility exclusively for export-oriented engine production as part of its broader global strategy.

“Ford is going to be making engines at the Chennai plant,” one source said. “The facility will be focused entirely on exports.”

Ford ceased vehicle production in India in 2021 and formally exited the market in 2022 after years of limited success. Over its two-and-a-half-decade presence, the company struggled to secure a significant share in the competitive Indian automotive sector.

Despite earlier speculation that Ford might abandon its India plans, particularly amid global policy shifts promoting local manufacturing in other regions, the latest updates confirm the company’s commitment to repurposing the Chennai unit.

Recent high-level discussions between Ford executives and the Tamil Nadu government have reaffirmed this direction, with the automaker indicating its long-term intent to operate in the state through export-led manufacturing.

The company also maintains an export presence through its former facility in Sanand, Gujarat, much of which was sold to Tata Motors two years ago. The remaining assets continue to support Ford’s global supply chain.

While Ford previously explored the possibility of re-entering the Indian market with electric vehicles—including feasibility studies for models like the Mustang, Endeavour, and Everest—those initiatives are currently on hold in light of the new export-focused model.

Ford has shut down all its dealerships in India, retaining only service centres to support existing customers. Industry experts view the current strategy as a pivot from domestic sales to leveraging India’s manufacturing capabilities for global supply.

An official announcement detailing the full scope of the Chennai plant’s reactivation is expected in the second quarter of this year.

-

Fashion9 years ago

These ’90s fashion trends are making a comeback in 2017

-

Entertainment9 months ago

Entertainment9 months agoSquid Game Season 3 Trailer Teases a Brutal Finale: Gi-hun Returns for One Last Game

-

Business9 years ago

The 9 worst mistakes you can ever make at work

-

AI/ML4 weeks ago

AI/ML4 weeks agoAdobe unveils Firefly Foundry to build IP-safe generative AI models for studios

-

Fashion9 years ago

According to Dior Couture, this taboo fashion accessory is back

-

Science8 months ago

Science8 months agoVera C. Rubin Observatory Unveils First-Ever 3,200-Megapixel Images

-

Sports9 years ago

Phillies’ Aaron Altherr makes mind-boggling barehanded play

-

Business9 years ago

Uber and Lyft are finally available in all of New York State